UnitedHealth Group Q3 2025 Comprehensive Analysis: Resilient Performance Amid Industry Headwinds

Executive Summary

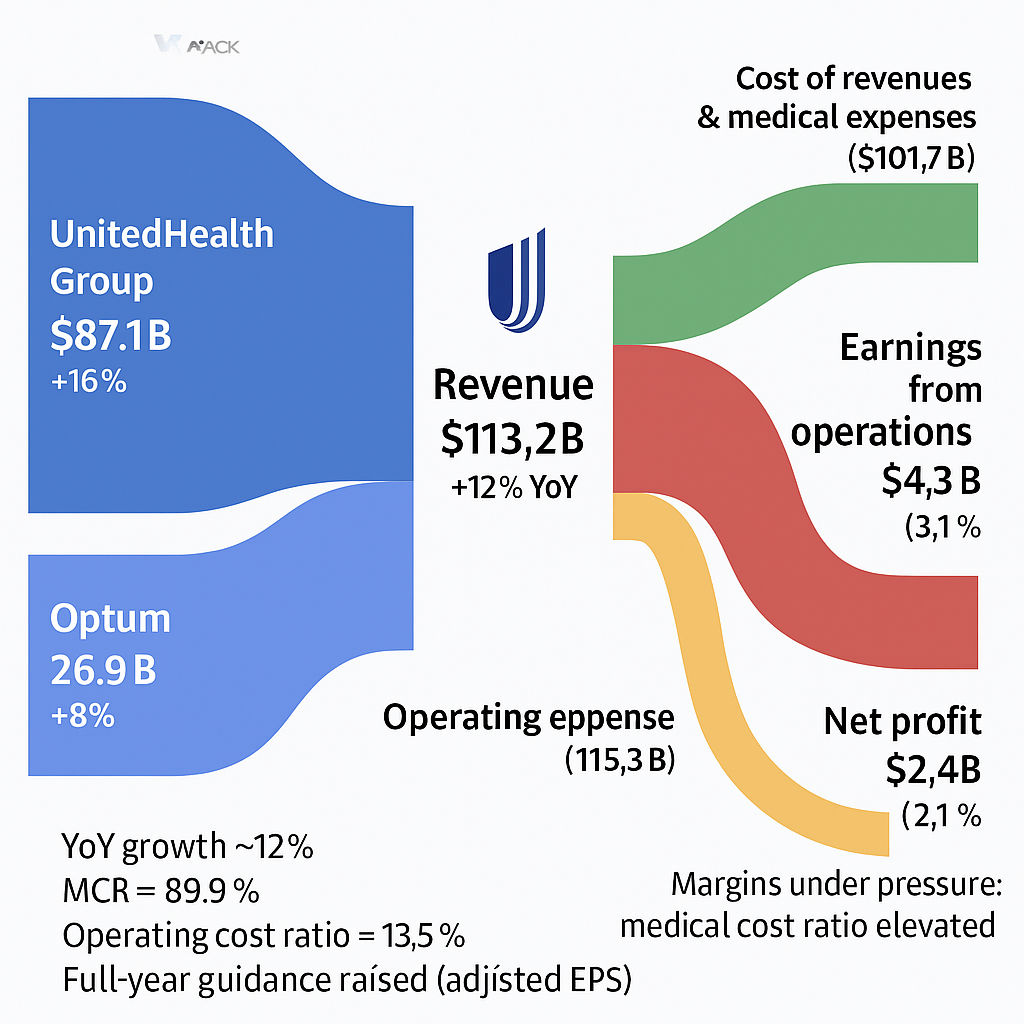

UnitedHealth Group (NYSE: UNH) delivered a solid Q3 2025 performance that exceeded Wall Street expectations despite facing significant industry-wide challenges. The healthcare giant reported revenues of $113.2 billion, representing a robust 12% year-over-year growth, while adjusted earnings per share of $2.92 beat analyst consensus of $2.82.

However, the company faces mounting pressure from elevated medical costs, regulatory changes, and competitive dynamics that have compressed margins significantly. Despite these challenges, management's decision to raise full-year guidance signals confidence in the company's ability to navigate the complex healthcare landscape.

Financial Performance Deep Dive

Revenue Growth Drivers

Total Revenue: $113.2B (+12% YoY)- UnitedHealthcare: $87.1B (+16% YoY)- Optum: $69.2B (+8% YoY)

The revenue growth was primarily driven by several key factors:

Medicare Advantage expansion represents the company's strongest growth engine, with enrollment continuing to increase as more seniors choose Medicare Advantage plans over traditional Medicare. This segment benefits from UnitedHealth's extensive provider networks and comprehensive benefit packages that attract new members.

Medicaid services demonstrated robust performance in government-sponsored programs, reflecting the company's ability to effectively manage costs while serving lower-income populations. The expansion of Medicaid programs in various states has created additional growth opportunities for UnitedHealth.

Optum Rx growth showcased the resilience of the company's pharmacy benefit management services, which benefit from increased prescription drug utilization and the company's ability to negotiate favorable drug pricing arrangements with pharmaceutical manufacturers.

Commercial membership remained stable in employer-sponsored health plans, indicating that businesses continue to trust UnitedHealth's offerings despite economic uncertainties and competitive pressures in the group insurance market.

Profitability Under Pressure

Key Profitability Metrics:

GAAP EPS of $2.59 reflects the company's earnings under generally accepted accounting principles, including all one-time charges and adjustments that provide a comprehensive view of actual profitability.

Adjusted EPS of $2.92 exceeded Wall Street estimates of $2.82, demonstrating management's ability to deliver results above market expectations despite operational headwinds. This adjusted figure removes certain non-recurring items to provide a clearer picture of underlying business performance.

Operating Income declined dramatically to $4.3 billion from $8.7 billion in Q3 2024, representing a concerning 50.6% decrease that highlights the significant pressure on the company's core business operations from rising medical costs.

Net Margin compressed to just 2.1% compared to 5.6% in the prior year quarter, indicating that the company is retaining far less profit from each dollar of revenue due to escalating medical expenses and operational challenges.

Operating Cash Flow of $5.9 billion remained strong at 2.3 times net income, demonstrating the company's ability to convert earnings into actual cash, which is crucial for dividend payments, capital investments, and debt service.

Critical Margin Analysis

Medical Care Ratio (MCR): 89.9% The 470 basis point increase in MCR represents the most significant operational challenge facing UnitedHealth, indicating that medical costs now consume 89.9% of premium revenues compared to 85.2% in the prior year. This dramatic deterioration reflects several interconnected factors:

Post-pandemic medical utilization normalization has exceeded all company projections, as patients who deferred care during COVID-19 are now seeking treatment at unprecedented rates. This "catch-up" effect has proven more costly and sustained than management anticipated.

Increased outpatient visits and specialist care demand has created a cascading effect throughout the healthcare system, with members requiring more complex and expensive treatments that were previously delayed. Emergency room visits, surgical procedures, and specialized treatments have all surged beyond pre-pandemic levels.

Higher than anticipated costs for new Medicare Advantage enrollees suggests that UnitedHealth may have underestimated the health status and care needs of members who enrolled in recent periods, leading to adverse selection where sicker patients disproportionately chose UnitedHealth plans.

Inflationary pressures across the healthcare delivery system have increased the cost of everything from medical devices and pharmaceuticals to hospital services and physician fees, creating broad-based expense inflation that is difficult to mitigate through operational efficiencies alone.

Market Sentiment and Analyst Perspectives

Media Response Overview

The market's reaction to UNH's Q3 results was predominantly positive, with shares surging over 4% in pre-market trading following the earnings announcement.

| Source | Sentiment | Key Highlight ||--------|-----------|---------------|| Yahoo Finance | Positive | Q3 EPS beat expectations by 6.18%, despite revenue slightly missing || Investing.com | Positive | Revenue up 12% YoY, full-year guidance raised, pre-market gains of 3.83% || TipRanks | Positive | Significant quarterly revenue increase confirms growth narrative || Seeking Alpha | Neutral+ | Long-term outlook stable but highlights healthcare coverage risks |

Wall Street Analyst Views

Recent Rating Changes reflect divergent views on UnitedHealth's prospects:

Deutsche Bank's downgrade from Buy to Hold signals growing concern about valuation levels relative to near-term earnings challenges. The firm believes that while the company executed well on earnings, the current stock price may not adequately reflect the ongoing margin pressures and competitive headwinds facing the business.

UBS, Jefferies, and Goldman Sachs maintained their Buy ratings and actually raised price targets to as high as $430, indicating these firms believe the current operational challenges are temporary and that UnitedHealth's long-term competitive position and growth prospects justify higher valuations.

MarketBeat Consensus of Moderate Buy with $395.64 target price represents the average view across Wall Street analysts, suggesting cautious optimism about the stock's prospects with modest upside potential from current trading levels.

Key Analyst Themes emerging from Q3 results:

Earnings execution has impressed analysts who recognize the difficulty of beating expectations in the current environment. UnitedHealth's ability to deliver adjusted EPS above consensus while managing significant cost pressures demonstrates operational competence and effective expense management.

Guidance confidence is viewed positively by the analyst community, as management's decision to raise full-year projections despite ongoing challenges signals that executives see improving trends in the business and have confidence in their ability to navigate current headwinds.

Valuation concerns are becoming more pronounced among some analysts who question whether the current stock price adequately reflects the risks associated with sustained margin pressure, regulatory changes, and competitive dynamics that could persist longer than initially expected.

Long-term fundamentals remain attractive to most analysts, who point to the aging baby boomer population, increasing Medicare Advantage penetration, and UnitedHealth's market-leading position as drivers that should support sustained growth over the next decade regardless of near-term operational challenges.

Competitive Landscape Analysis

Industry Performance Comparison

UnitedHealth's challenges in 2025 contrast sharply with competitor performance:

Outperforming Peers have demonstrated superior operational execution:

Humana has implemented more effective cost control measures earlier in the cycle, including enhanced medical management programs, improved provider contracting, and more conservative underwriting practices that have helped the company better manage medical cost inflation.

Elevance Health delivered stronger Q1 2025 results with better margin preservation through disciplined pricing strategies and more accurate medical cost forecasting, allowing the company to adjust premium rates more effectively to account for increased utilization trends.

Aetna has demonstrated superior pricing model adjustments for increased care demand by implementing more sophisticated actuarial models and risk assessment tools that have enabled better prediction and management of medical costs across their membership base.

UNH's Competitive Response leverages several enduring advantages:

Despite facing operational headwinds, UnitedHealth maintains significant competitive advantages that differentiate it from peers:

Market leadership position as the largest Medicare Advantage provider gives UnitedHealth unparalleled scale and influence in the industry. This dominant market share provides pricing power with providers and pharmaceutical companies while spreading fixed costs across a larger membership base.

Vertical integration through the Optum platform creates a unique value proposition that competitors struggle to replicate. By owning healthcare providers, pharmacy services, and technology platforms, UnitedHealth can coordinate care more effectively and capture value across the entire healthcare delivery chain.

Scale advantages enable superior negotiating power with healthcare providers, pharmaceutical manufacturers, and medical device companies. The company's size allows it to secure more favorable contracts and pricing arrangements that smaller competitors cannot achieve.

Advanced data capabilities and analytics provide sophisticated tools for risk management and care coordination that help identify high-risk patients, predict medical costs, and implement preventive care programs that can reduce overall healthcare expenses over time.

Strategic Positioning

UnitedHealth's vertically integrated model through Optum continues to differentiate the company across three key business segments:

Optum Health operates one of the largest networks of healthcare providers in the United States, including primary care physicians, specialists, and ambulatory surgery centers. This vertical integration allows UnitedHealth to directly control care delivery, reduce costs through operational efficiencies, and improve patient outcomes through coordinated care models.

Optum Insight provides technology and consulting services that drive innovation across the healthcare industry. This division offers data analytics, population health management tools, and revenue cycle management services to healthcare providers, helping them improve operational efficiency while generating substantial revenue for UnitedHealth.

Optum Rx operates as one of the largest pharmacy benefit managers in the country, processing billions of prescriptions annually. This scale provides significant negotiating power with pharmaceutical manufacturers and allows UnitedHealth to manage drug costs more effectively for its health plan members.

Regulatory Environment and Industry Trends

Medicare Advantage Challenges

Risk Adjustment System (v28) Implementation:

The Centers for Medicare & Medicaid Services (CMS) is implementing the final phase of a new risk adjustment methodology that fundamentally changes how Medicare Advantage plans are reimbursed. This new system reduces payments for high-severity cases by using updated diagnostic coding that more accurately reflects patient health status. The methodology change is designed to prevent over-coding and ensure that Medicare payments more closely align with actual patient care needs.

For UnitedHealth, this represents a significant revenue headwind as the company has historically benefited from the previous risk adjustment system. The new methodology will reduce CMS reimbursement rates across the industry, but UnitedHealth's large Medicare Advantage membership means it faces proportional exposure to these payment reductions.

STAR Rating System Changes:

CMS has updated its STAR rating methodology to make achieving the critical 4-star rating significantly more difficult for Medicare Advantage plans. The new system includes more stringent quality measures and higher performance thresholds that plans must meet to qualify for bonus payments. These bonus payments can represent substantial additional revenue for high-performing plans, making the rating changes particularly impactful.

The updated system reduces bonus payment opportunities across the industry, directly affecting profitability for Medicare Advantage providers. Plans that previously qualified for bonus payments may no longer meet the new criteria, resulting in lost revenue. This change requires health plans to enhance their focus on quality metrics, member satisfaction scores, and clinical outcomes to maintain competitive ratings and preserve bonus payment eligibility.

Regulatory Outlook Under New Administration

Potential Policy Changes under the new administration:

The incoming Trump administration is expected to implement policies more favorable to Medicare Advantage programs, potentially reversing some of the restrictive regulations implemented in recent years. This could include modifications to risk adjustment methodologies, STAR rating requirements, and administrative burden reductions that would benefit private Medicare plans.

Anticipated reduction in regulatory pressure on Medicare Advantage programs could result in more favorable reimbursement rates, relaxed quality reporting requirements, and greater flexibility in benefit design. These changes would directly benefit UnitedHealth's largest business segment.

Market optimism following the election has already been reflected in higher valuations for insurance sector stocks, as investors anticipate a more business-friendly regulatory environment that could improve profitability for Medicare Advantage providers.

Healthcare Technology and Cybersecurity

Change Healthcare Cyberattack Impact:

The cyberattack against Change Healthcare in early 2024 was a watershed moment for the healthcare industry, exposing personal health information for over 100 million Americans and disrupting healthcare operations nationwide. As a subsidiary of UnitedHealth Group, Change Healthcare processes medical claims and payments for thousands of healthcare providers across the country.

This incident highlighted the interconnected nature of modern healthcare technology infrastructure, where a single point of failure can cascade throughout the entire healthcare system. Hospitals, physician practices, and pharmacies were unable to process insurance claims for weeks, demonstrating how dependent the industry has become on centralized technology platforms.

The attack demonstrated the vulnerability of integrated healthcare systems like UnitedHealth's, where extensive data collection and technology integration create attractive targets for cybercriminals. The incident has forced UnitedHealth to make substantial ongoing investments in cybersecurity infrastructure to protect against future attacks and maintain customer confidence.

Operational Challenges and Management Response

Medical Cost Management

**Key Cost Drivers:**1. Utilization normalization: Post-pandemic care catch-up exceeding projections2. Specialist care demand: Increased referrals and follow-up appointments3. Inflation impact: General healthcare cost inflation pressures4. New member mix: Medicare Advantage enrollees requiring more care than anticipated

Management Initiatives to Address Cost Pressures:

Enhanced predictive analytics for medical cost forecasting involves deploying advanced machine learning algorithms and artificial intelligence to better predict member health needs and associated costs. These tools analyze vast amounts of historical claims data, demographic information, and clinical indicators to identify patterns that can help anticipate future medical expenses more accurately.

Provider network optimization focuses on improving cost efficiency by renegotiating contracts with healthcare providers, encouraging the use of lower-cost, high-quality providers, and implementing value-based care arrangements that reward providers for achieving better patient outcomes at lower costs.

Care management programs targeting high-risk populations represent intensive interventions designed to identify members with chronic conditions or complex health needs early and provide coordinated care to prevent expensive emergency room visits and hospital admissions.

Technology investments in preventive care and chronic disease management include digital health platforms, remote monitoring tools, and telemedicine capabilities that can help members manage their health more effectively while reducing the need for costly in-person medical services.

2026 Medicare Bidding Strategy

UnitedHealth is fundamentally adjusting its approach for 2026 Medicare Advantage bids in response to current challenges:

Pricing discipline involves implementing more conservative pricing strategies that better account for the elevated medical cost trends experienced in 2024 and 2025. This means setting premium rates higher than historical levels to ensure adequate margins, even if it results in slower membership growth.

Product redesign includes modifying benefit structures to improve profitability while maintaining member appeal. This could involve adjusting copayments, deductibles, and covered services to better align with actual utilization patterns and cost trends.

Geographic focus represents a strategic shift toward selective market participation based on profitability analysis. UnitedHealth may exit or reduce presence in markets where regulatory constraints, provider costs, or competitive dynamics make profitable operations difficult.

Quality investments involve enhanced programs designed to maintain high STAR ratings under the new, more stringent CMS methodology. These investments in member services, care coordination, and health outcomes are essential to preserve bonus payment eligibility that significantly impacts profitability.

Q4 2025 and 2026 Outlook

Raised Guidance Analysis

Updated 2025 Projections:- GAAP EPS: ≥ $14.90 per share- Adjusted EPS: ≥ $16.25 per share- Revenue growth: Continued double-digit expansion expected

The guidance raise demonstrates management confidence despite operating challenges, suggesting several positive developments:

Q4 cost stabilization indicates management expects medical cost trends to moderate in the fourth quarter, possibly due to seasonal patterns, improved care management programs, or the natural normalization of post-pandemic utilization patterns. This suggests that the worst of the medical cost inflation may be behind the company.

Strong Optum performance reflects the diversified business segments' ability to generate consistent profits that help offset challenges in the core insurance business. Optum's provider services, pharmacy benefits, and technology offerings continue to grow and contribute meaningfully to overall company profitability.

Effective pricing actions suggest that rate adjustments implemented throughout 2025 are beginning to show results, with premium increases helping to offset higher medical costs. This indicates management's ability to successfully navigate the complex process of obtaining regulatory approval for necessary rate increases.

Key Monitoring Metrics

Critical metrics investors should monitor closely:

Medical Care Ratio trends represent the most important indicator of UnitedHealth's operational performance, as quarter-over-quarter changes in MCR directly reflect the company's ability to manage medical costs relative to premium revenue. Improving trends would signal successful cost management initiatives.

Medicare STAR ratings for 2026 will determine bonus payment eligibility under the new, more stringent CMS methodology. These ratings, typically released in late 2025, will significantly impact 2026 profitability and help investors assess UnitedHealth's competitive position.

Optum margin contribution measures how effectively the company's diversified business segments are offsetting challenges in the core insurance business. Increasing profitability from Optum services helps stabilize overall company performance.

Regulatory developments affecting Medicare reimbursement rates, risk adjustment methodologies, and STAR rating requirements can have massive financial impacts. Changes in federal healthcare policy directly affect UnitedHealth's largest revenue sources.

Competitive positioning through market share trends in Medicare Advantage, Medicaid, and commercial segments indicates whether UnitedHealth is maintaining its leadership position or losing ground to better-performing competitors.

Risk Factors for 2026

Near-term Risks that could impact performance:

Sustained medical cost inflation represents the most immediate threat, as healthcare utilization patterns continue to exceed pre-pandemic levels with no clear indication of when normalization might occur. Continued pressure from increased doctor visits, delayed surgeries, and pent-up demand for medical services could persist well into 2026.

Regulatory implementation poses significant challenges as the full impact of Medicare risk adjustment changes and STAR rating modifications becomes apparent. These regulatory shifts could reduce reimbursement rates and bonus payments more than currently anticipated, further pressuring profitability.

Competitive pressure from better-performing peers like Humana and Aetna could result in market share losses if UnitedHealth cannot match their cost management effectiveness. Members and employers may shift to competitors that demonstrate better financial performance and pricing stability.

Economic sensitivity to potential recession could significantly impact employer-sponsored coverage as businesses look to reduce costs by eliminating or reducing health benefits, or by switching to lower-cost alternatives, potentially affecting UnitedHealth's commercial membership base.

Potential Catalysts that could drive outperformance:

Medicare Advantage growth represents a massive structural opportunity, with industry penetration projected to reach 54.6% by 2028 as more seniors choose Medicare Advantage over traditional Medicare. This growth is driven by superior benefits, lower out-of-pocket costs, and comprehensive care coordination that Medicare Advantage plans provide.

Technology integration through artificial intelligence and advanced data analytics is beginning to show meaningful improvements in cost management capabilities. These technologies can identify high-risk patients earlier, predict medical cost trends more accurately, and enable more effective care interventions that reduce overall healthcare expenses.

Policy environment improvements under the new Trump administration could provide significant tailwinds for Medicare Advantage, with anticipated reductions in regulatory pressure and potential policy changes that favor private Medicare plans over traditional government-administered programs.

Optum expansion continues to drive growth in healthcare services, with the platform's provider networks, pharmacy services, and technology offerings creating additional revenue streams and operational synergies that strengthen UnitedHealth's competitive position across the healthcare value chain.

Investment Thesis and Recommendations

Bull Case Arguments

Long-term Structural Growth Drivers:

Demographic tailwinds from the aging baby boomer population create an unstoppable force driving Medicare growth over the next decade. Approximately 10,000 Americans turn 65 every day, and this trend will continue through 2030, creating a massive and growing addressable market for Medicare Advantage plans.

Market leadership position in the rapidly growing Medicare Advantage market provides UnitedHealth with a dominant competitive position. As the largest Medicare Advantage provider, the company benefits from scale advantages, brand recognition, and established provider relationships that are difficult for competitors to replicate.

Optum differentiation through vertical integration creates unique competitive moats that distinguish UnitedHealth from traditional insurance companies. By owning healthcare providers, pharmacy services, and technology platforms, the company can control costs and coordinate care in ways that competitors cannot match.

Financial strength demonstrated through strong balance sheet metrics and consistent cash generation capabilities provides the resources necessary to invest in growth initiatives, weather operational challenges, and return capital to shareholders through dividends and share repurchases.

Management track record of successfully adapting to regulatory changes and industry disruptions over decades provides confidence that the company can navigate current challenges. UnitedHealth has consistently outperformed during previous periods of healthcare industry transformation.

Valuation Perspective:- Trading at reasonable multiple considering long-term growth prospects- Temporary margin pressure creating potential entry opportunity- Diversified business model reducing single-point-of-failure risks

Bear Case Considerations

Operational Challenges that concern investors:

Margin compression raises fundamental questions about sustainable profitability in the current environment. The dramatic decline in operating margins from 5.6% to 2.1% suggests that cost pressures may be more structural than cyclical, potentially requiring permanent adjustments to business models and profit expectations.

Regulatory uncertainty surrounding ongoing Medicare policy changes continues to impact business economics in unpredictable ways. Future modifications to risk adjustment methodologies, STAR rating requirements, or reimbursement rates could further pressure profitability and make long-term planning difficult.

Competitive dynamics reveal that peers like Humana and Aetna have demonstrated superior cost management capabilities, suggesting that UnitedHealth's challenges may be company-specific rather than industry-wide. This raises questions about management execution and operational efficiency.

Execution risk centers on management's ability to implement necessary operational changes quickly and effectively. The company must simultaneously manage medical costs, adapt to regulatory changes, and maintain competitive positioning while preserving profitability and market share.

Valuation Concerns:- Current stock price may not fully reflect near-term headwinds- Multiple compression risk if margin recovery proves elusive- Sector rotation away from healthcare amid broader market uncertainty

Price Target Analysis

Wall Street Consensus:- Average Price Target: $395.64- Rating Distribution: Moderate Buy- Upside Potential: ~8-12% from current levels

Institutional Targets:- UBS/Jefferies/Goldman Sachs: $430 (Buy rating)- Deutsche Bank: Hold rating (valuation concerns)- MarketBeat: $395.64 consensus target

Investment Review: HOLD/MODERATE BUY

**Rationale:**UnitedHealth Group presents a compelling long-term investment opportunity supported by favorable demographics and market position. However, near-term operational challenges and margin pressures warrant a cautious approach. The company's ability to navigate current headwinds while maintaining market leadership will determine future performance.

Recommended Investment Strategies by investor type:

Long-term investors should consider accumulating shares on weakness while maintaining a 2-3 year investment horizon. The current operational challenges are likely temporary, and demographic trends will drive sustained growth in UnitedHealth's core markets over time. Dollar-cost averaging during periods of volatility could provide attractive entry points.

Value investors may find the current valuation compelling if management successfully implements margin recovery initiatives. The stock's decline from peak levels may have created an opportunity to invest in a market-leading healthcare company at a discount to intrinsic value.

Income-focused investors can take comfort in dividend sustainability supported by strong cash flow generation. UnitedHealth's ability to generate $5.9 billion in operating cash flow demonstrates the financial strength necessary to maintain and potentially grow dividend payments even during challenging periods.

Risk-averse investors should wait for clearer evidence of medical cost trend stabilization before initiating positions. Concrete signs of MCR improvement, successful 2026 Medicare bid outcomes, or competitive positioning gains would provide greater confidence in the investment thesis.

Key Performance Indicators to Monitor

Quarterly Metrics that signal business health:

Medical Care Ratio serves as the primary indicator of cost management effectiveness, directly measuring how much of premium revenue is consumed by medical expenses. Investors should track both absolute MCR levels and quarter-over-quarter trends to assess management's success in controlling costs.

Optum revenue growth demonstrates the company's success in diversifying beyond traditional insurance and enhancing overall profitability through higher-margin healthcare services. Strong Optum performance can offset insurance margin pressures.

Medicare enrollment trends indicate market share performance and growth trajectory in UnitedHealth's most important business segment. Membership growth combined with improved margins would signal successful competitive positioning.

Operating cash flow provides the clearest measure of financial strength and dividend sustainability, showing the company's ability to convert earnings into actual cash that can be used for capital allocation and shareholder returns.

Annual Trends that shape long-term performance:

STAR rating performance directly impacts bonus payment eligibility and competitive positioning in the Medicare Advantage market. Higher ratings translate to substantial additional revenue while also making plans more attractive to prospective members.

Regulatory compliance costs reflect the company's ability to adapt efficiently to evolving healthcare policy. Rising compliance expenses could signal challenges in navigating regulatory changes, while stable costs would indicate effective adaptation.

Technology investment return on investment measures the effectiveness of digital transformation initiatives in improving operational efficiency and member experience. Successful technology investments should translate to lower administrative costs and better health outcomes.

Market share evolution across Medicare Advantage, Medicaid, and commercial segments indicates competitive positioning relative to peers. Maintaining or gaining market share while preserving profitability demonstrates successful business execution.

Conclusion

UnitedHealth Group's Q3 2025 results demonstrate the company's resilience in navigating a challenging healthcare environment. While near-term margin pressures and regulatory headwinds present legitimate concerns, the company's fundamental market position, diversified business model, and strong financial foundation support a constructive long-term outlook.

The raised guidance and management confidence, combined with favorable demographic trends and potential regulatory relief, suggest that current challenges may prove temporary. However, investors should carefully monitor the company's execution on cost management initiatives and competitive positioning relative to peers who have demonstrated superior margin preservation.

For long-term investors willing to weather near-term volatility, UnitedHealth Group continues to offer attractive exposure to the growing healthcare sector with the potential for sustainable outperformance as operational challenges are addressed.

Sources and Disclaimers

*This analysis is based on publicly available financial data, company reports, and market information as of October 30, 2025. Investment decisions should be made in consultation with qualified financial advisors and consider individual risk tolerance and investment objectives.

Key Sources:- UnitedHealth Group Q3 2025 Earnings Report- SEC filings and investor presentations- Wall Street analyst reports and ratings- Industry research and competitive analysis- Healthcare policy and regulatory updates

Stock prices and analyst targets are subject to change. Past performance does not guarantee future results.

- Reporto reminds