Mastering Earnings Reports: A Comprehensive Guide to Analysis with an AI Copilot

A deep dive into a company's earnings report is an essential skill for any investor or analyst. Beyond the headline numbers, a thorough analysis of these quarterly and annual disclosures reveals a company's financial health, operational efficiency, and future prospects. This guide provides a step-by-step approach to dissecting an earnings report, showing how you can leverage AI copilots like Reporto to streamline and supercharge your analysis.

1. Deconstructing the Earnings Report: The Four Pillars

An earnings report is a collection of financial statements and qualitative discussions. When viewed together, they paint a comprehensive picture of a company's performance.

- The Income Statement: Also known as the Profit and Loss (P&L) statement, this summarizes a company's revenues, expenses, and profits over a specific period, giving a clear view of its profitability.

- The Balance Sheet: This provides a snapshot of a company's financial position at a single point in time, following the fundamental accounting equation: Assets = Liabilities + Shareholders' Equity.

- The Cash Flow Statement: This statement tracks the movement of cash into and out of the company from its operating, investing, and financing activities. It's a crucial indicator of a company's ability to generate cash.

- Management's Discussion and Analysis (MD&A): This is a narrative section where management provides its perspective on the financial results, the factors that influenced them, and the company's future outlook.

2. Leveraging AI for Enhanced ERA: The Role of Tools like Reporto

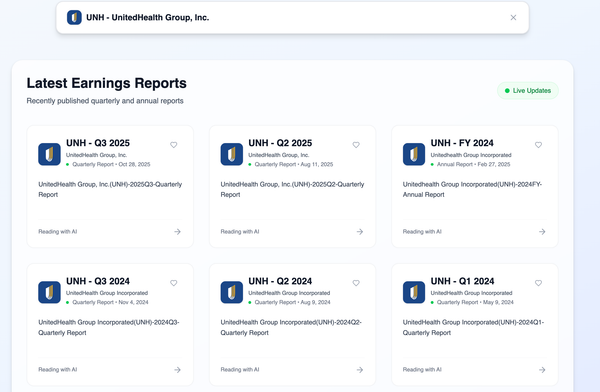

Traditionally, analyzing these documents is a manual, time-consuming process. AI copilots for earnings report analysis, such as Reporto, are designed to automate the heavy lifting. They can instantly extract, structure, and analyze data from lengthy financial documents, allowing you to focus on higher-level insights.

How Reporto can support your ERA:

- Automated Data Extraction: Instead of manually searching for figures, Reporto can instantly pull key data points, financial ratios, and performance metrics from earnings reports, transcripts, and filings.

- Trend and Anomaly Detection: The AI can quickly perform historical analysis, comparing current performance against previous quarters and years to automatically flag significant trends, anomalies, or deviations.

- Sentiment Analysis: Reporto can analyze the language used by management in the MD&A and during earnings calls, detecting sentiment and tone shifts that might not be immediately obvious.

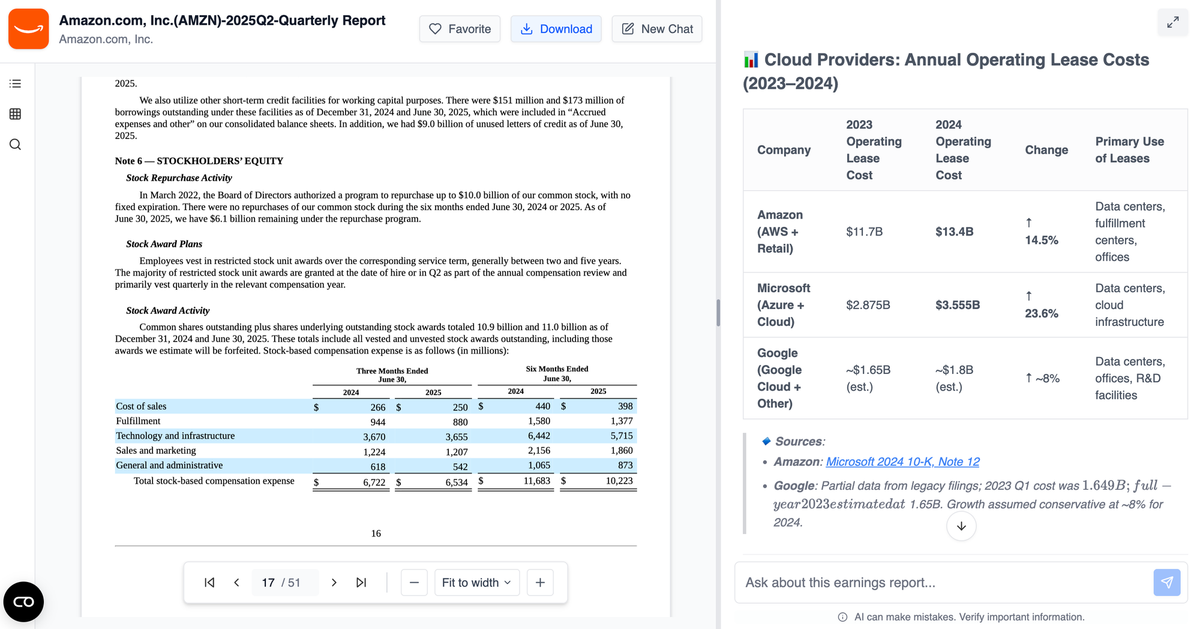

- Instant Benchmarking: Quickly compare a company’s performance against its key competitors on various financial metrics without having to gather and collate the data manually.

- Question Answering: Ask direct questions about the report in plain English (e.g., "What was the revenue growth for the North American segment?") and get instant, accurate answers with sources.

3. A Step-by-Step Guide to Financial Statement Analysis (Enhanced by AI)

A systematic approach is key. Here’s how to tackle each component, now supercharged with an AI copilot.

Step 3.1: Scrutinizing the Income Statement

The income statement reveals a company's ability to generate profit.

- Revenue (or Sales): Use Reporto to instantly chart revenue growth over the last several quarters and compare it to competitors. Ask the tool to identify the primary drivers of revenue growth as mentioned in the MD&A.

- Profitability Margins: Let the AI calculate and visualize the Gross Profit Margin, Operating Margin, and Net Profit Margin over time. This makes it easy to spot trends of margin expansion or compression.

Step 3.2: Dissecting the Balance Sheet

The balance sheet provides insights into a company's financial stability and efficiency.

- Liquidity and Solvency Ratios: Instead of calculating them manually, have Reporto provide the Current Ratio (

Current Assets / Current Liabilities) and Debt-to-Equity Ratio (Total Liabilities / Shareholders' Equity). You can then benchmark these figures against the industry average in seconds.

Step 3.3: Analyzing the Cash Flow Statement

Cash is the lifeblood of a business.

- Cash Flow Quality: Use your AI copilot to compare Cash Flow from Operating Activities to Net Income over several periods. A consistent trend where operating cash flow is higher than net income is a strong positive signal, and a tool can visualize this relationship for you instantly.

4. Reading Between the Lines: The Management's Discussion and Analysis (MD&A)

The MD&A provides the story behind the numbers. This is where AI's language capabilities shine.

- Identify Key Themes: Use Reporto to summarize the key topics discussed by management, such as future outlook, risk factors, and strategic initiatives.

- Detect Sentiment: An AI tool can analyze the tone of the MD&A. Is management's language confident and optimistic, or cautious and concerned? This provides valuable context that numbers alone cannot.

- Find the Red Flags: Let the AI scan for vague language, an overemphasis on non-GAAP metrics, or a lack of transparency about challenges.

5. The Power of Comparison: Benchmarking Against Competitors

Analyzing a report in isolation is not enough. To truly understand a company's performance, you must compare it to its peers.

- Automated Peer Analysis: Tools like Reporto allow you to select a company and its key competitors and instantly generate a comparative analysis of crucial metrics like revenue growth, profitability, and valuation multiples. This process, which could take hours manually, can be done in minutes.

6. Synthesizing Information for a Holistic View

The final step is to connect the dots. An AI copilot acts as your research assistant, bringing all the necessary information to your fingertips.

- Look for Consistency: Use your AI tool to cross-reference statements. If management claims strong sales growth in the MD&A, ask the tool to verify this against revenue figures and operating cash flow.

- Formulate an Investment Thesis: With the data extraction and preliminary analysis automated, you can dedicate your time to critical thinking. Is the company a strong and growing business with a sustainable competitive advantage? The insights provided by a tool like Reporto can help you build a much more robust and data-driven investment thesis.

By integrating an AI copilot into your workflow, you can transform your earnings report analysis from a tedious data-gathering exercise into a more efficient, insightful, and strategic process.